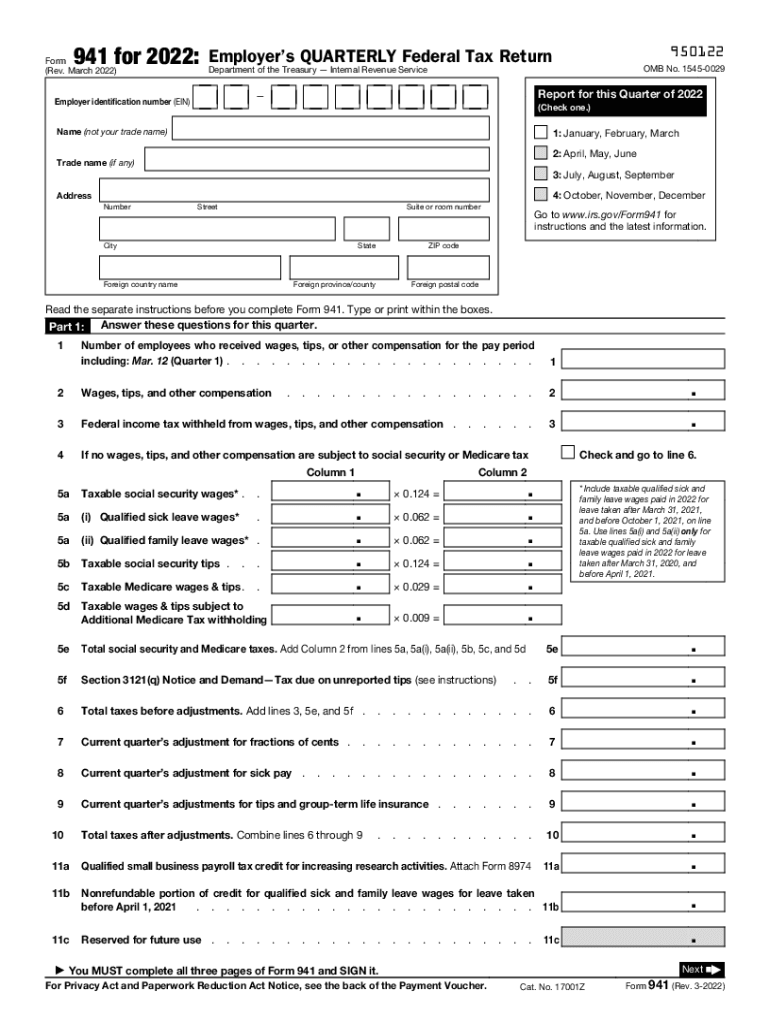

Irs Gov 2022-2025 Form

What makes the form 941 legally binding?

As the society takes a step away from in-office working conditions, the completion of documents increasingly occurs electronically. The 2020 form 941 isn’t an any different. Handling it utilizing digital means is different from doing so in the physical world.

An eDocument can be regarded as legally binding given that specific requirements are fulfilled. They are especially vital when it comes to signatures and stipulations related to them. Entering your initials or full name alone will not guarantee that the organization requesting the sample or a court would consider it executed. You need a trustworthy solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your irs form 941 when filling out it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make document execution legitimate and safe. In addition, it offers a lot of opportunities for smooth completion security smart. Let's rapidly run through them so that you can be certain that your 2020 941 remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of protection and validates other parties' identities via additional means, such as an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information safely to the servers.

Completing the 941 form 2020 pdf with airSlate SignNow will give better confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete 941 form 2020 pdf

Effortlessly Prepare internal revenue service 941 form on Any Device

Digital document management has gained signNow traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage 941 form 2020 on any device utilizing the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The Simplest Way to Edit and Electronically Sign form 941 2020 Without Stress

- Locate us gov forms 941 and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Modify and electronically sign form 941 for 2020 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Form 941 Rev March Employer's Quarterly Federal Tax Return

Instructions and help about internal revenue service 941 form

Find and fill out the correct 941 form 2020

Related searches to us gov forms 941

Create this form in 5 minutes!

How to create an eSignature for the form 941 for 2020

The way to generate an e-signature for your PDF file in the online mode

The way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask 941 form

-

How does airSlate SignNow ensure compliance with IRS gov regulations?

airSlate SignNow provides a secure platform that adheres to IRS gov standards for electronic signatures. Our system is designed to meet legal requirements, ensuring that your documents are valid and compliant. This helps businesses verify the authenticity and legality of their signed documents.

-

What pricing plans does airSlate SignNow offer for businesses concerned with IRS gov documents?

We offer various pricing plans tailored to meet the needs of different businesses dealing with IRS gov documents. Our pricing structures are transparent and offer flexibility, allowing you to choose a plan that fits your budget. Each plan includes essential features for efficient document management and eSigning.

-

What features make airSlate SignNow a top choice for managing IRS gov forms?

airSlate SignNow includes advanced features like templates, bulk sending, and robust security measures tailored for IRS gov forms. You can easily create, send, and track your documents in one seamless platform, which saves time and minimizes errors. Our user-friendly interface simplifies the signing process.

-

Can airSlate SignNow integrate with other software to facilitate IRS gov document workflows?

Yes, airSlate SignNow offers integrations with popular software to streamline your IRS gov document workflows. You can connect with tools like Google Drive, Salesforce, and others to create a comprehensive solution. This integration enhances efficiency and keeps everything organized in one place.

-

What benefits does airSlate SignNow provide for businesses filing IRS gov disclosures?

airSlate SignNow simplifies the process of filing IRS gov disclosures through efficient eSigning and document management. Our platform reduces the risk of errors and delays in your filing process. Businesses benefit from quicker turnaround times and better compliance with IRS requirements.

-

Is airSlate SignNow suitable for small businesses handling IRS gov documentation?

Absolutely! airSlate SignNow is an economical solution perfect for small businesses managing IRS gov documentation. Our platform is designed to be easy to use, even for those without extensive technical expertise, ensuring that everyone can navigate it effectively. The affordability and features support growth and efficiency.

-

How can I ensure my IRS gov documents are secure with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive IRS gov documents. We implement advanced encryption and authentication methods to protect your data throughout the signing process. Regular security audits ensure our platform remains compliant and safe for all users.

Get more for printable irs forms 2021

- Arrl radiogram software form

- Calista corporation dividend check direct deposit application form

- Dr michael g mcnamara md reviewsanchorage akvitals form

- Cuba travel affidavit form general specific licensing

- Chicken salad chick fax order form

- Frequently asked questions about our service form

- Alabama recad form

- Mill hill school pta standing rules form

Find out other 941 form 2021

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free